Chinese EVs: friend or foe?

By Erin Baker, Brand Ambassador

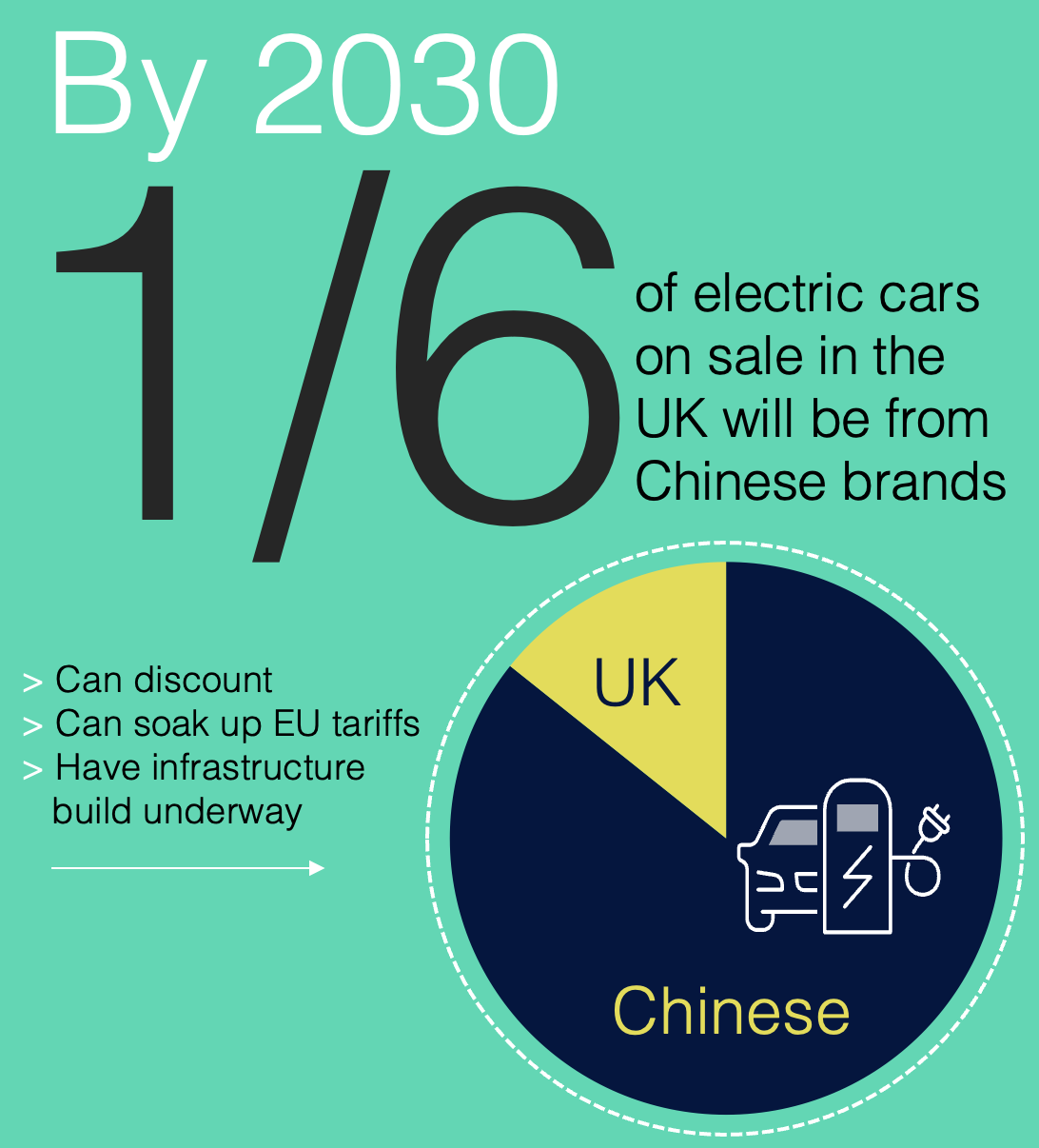

By 2030, one-sixth of electric cars on sale in the UK will be from Chinese brands, according to recent marketplace data. Is this a good or bad thing for the automotive industry? Is it good news for consumers, or not?

Should we view brands such as BYD, GWM Ora, Omoda, Zeekr, Seres and MG as friends or foes? One thing is clear already: Chinese brands have won the price war on electric cars, with their products being, in many cases, a third cheaper than competitors and crucially, having the ability to discount further.

Discover more content...

Chinese heavy discounts

New EVs stubbornly remain 30 per cent more expensive than their petrol equivalents, with an average price of £51,000 – that’s £30,000 more than most people expect to pay for their next car, according to Auto Trader’s latest “Road to 2035” report.

Meanwhile, the BYD Atto 3 and Omoda e5 electric SUVs carry a price tag of about £32,000. And the worrying fact for European manufacturers is that Chinese car brands can discount heavily on those prices, because they sell them for far less in their domestic markets, so even if you include the cost of exporting them to Europe and setting up sales platforms here, they can soak up the discounting.

They can also soak up any tariffs the EU ratifies, either by paying them or moving their manufacturing bases to European countries; whether the UK joins that ring-fenced market is unclear but seems unlikely, at which point, the UK will become an even more appealing market for the Chinese.

Ethical, Security & Environmental Impacts

So far, it sounds like good news for the consumer and bad news for legacy car makers in Europe.

However, a few salient facts stand out. The first is that a substantial portion of the public have concerns about buying Chinese electric cars.

They worry about the ethical, security and environmental impact of Chinese products.

The first two are tricky barriers for the Chinese, although consumer hesitancy over allowing these cars access to their biometric and travel data seems slightly odd given our willingness to use Chinese-manufactured phones, laptops and other goods, as well as buying cars from brands which already make them in China, such as Tesla.

The question over the ethics of forced labour and a lack of employee protection is harder for Chinese brands to navigate, and they may hope (probably correctly) that the cheap price tag brushes ethics under the carpet for many buyers.

"Chinese batteries demonstrate, in many instances, state-of-the-art technology honed in a market where 50 per cent of the car parc has switched to electricity, and they scaled up decades ago, with the largest volume of EVs on the road in any country"

Erin Baker

Journalist & EV Battery Solutions Brand Ambassador

Sustainability & China

But, talking to consumers about sustainability is one the Chinese can do much about. As in every other aspect of the supply chain, China has been the early bird that caught the worm (loads of them in fact).

The country planned early for the green revolution, investing heavily in renewables such as wind and solar, to the point where it now produces nearly all the world’s solar panels (albeit not in ethical ways), and by securing the entire value chain of critical minerals and rare earth metals for all its EVs, from mining to processing to manufacturing.

It has even built global cargo ships to export its cars that are powered by liquified natural gas to reduce emissions.

Chinese batteries demonstrate, in many instances, state-of-the-art technology honed in a market where 50 per cent of the car parc has switched to electricity, and they scaled up decades ago, with the largest volume of EVs on the road in any country.

Circular battery concerns

Now it’s time for Chinese brands, along with others, to start addressing consumer concerns about repairing, remanufacturing, recycling and reusing batteries.

Consumers aren’t stupid: they’ve been exposed to circular-economy conversations in other industries for years now – big fashion brands like H&M and Primark were forced to come to the table with transparency and a plan of action around fast fashion ages ago.

Consumers know all about buying better for longer and buying more responsibly.

They want to know what will happen to these electric cars if they buy them and they are damaged, and whether the batteries will be recycled or find a second life as energy-storage units.

The consumer-facing conversation needs to start now, with honesty and integrity from OEMs, or we will struggle to reach mass adoption of electric cars this decade, and that is a prospect neither the automotive industry nor the governments want to face.

Let's take charge of the future, together

We’re transforming the in-life battery operations of the world’s leading automotive manufacturers. Get in touch to find out how.